types of taxes in malaysia

A withholding tax mechanism to collect withholding tax at 10 on other types of income of non-residents under Section 4f of the Income Tax Act 1967 has been. Malaysia also has a reported critical occupations list COL highlighting job types where there is a skills shortage within the country that supports work permitsvisa applications.

Administrative summons can be issued by different types of administrative courts such as.

. Dividends interest royalties types of income. All customs duties and taxes imposed must have been paid before the goods are imported. This sales-tax rate varies from state to state and the swings can be big.

There are a number of different types of DIY SEO software available each with its own set of features and benefits. Malaysia has no WHT on dividends in addition to tax on the profits out of which the dividends are declared. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

The 3 Main Types of Taxes that Boat Owners Pay First theres the sales tax which you likely will have to pay when you buy the boat. Monetary receipts must have a revenue stamp of 04 of the amount received per piece. How Does DIY SEO Software Work.

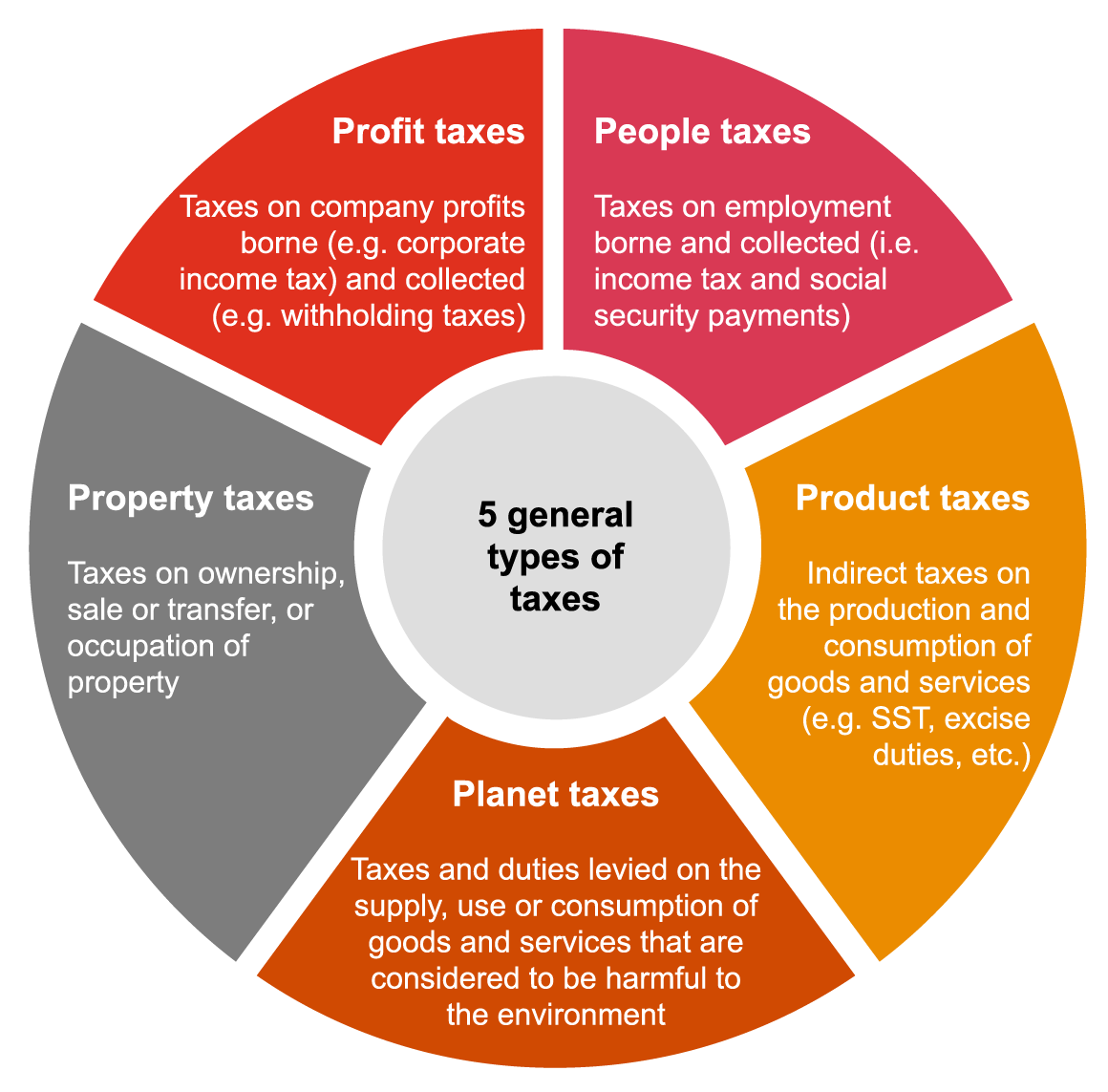

Gross easements and appurtenant easements. You pay some of them directly like the cringed income tax corporate tax wealth tax etc while you pay some of the taxes indirectly like sales tax service tax value added tax etc. On other types of payments that give rise to Colombian-source income the general WHT rate is 15 with the foreign non-resident payee being required to file a CIT return in Colombia to report the final CIT liability at the rates mentioned before on net income and being entitled to a refund where the final liability is less than the amount.

Referred client must have taxes prepared by 4102018. A tax haven is a jurisdiction with very low effective rates of taxation for foreign investors headline rates may be higher. Learn more about paying tax on ebay.

The deed tax rates range from 2 to 6 depending on the types of transactions involved. An employment pass a professional visit pass and a temporary employment pass. For example every jurisdiction will have a tax authority in charge of handling all matters related to taxes.

The empty string is the special case where the sequence has length zero so there are no symbols in the string. With Gseo being by far the most cost efficient. Referring client will receive a 20 gift card for each valid new client referred limit two.

This exemption covers both active eg. Your tax authority may have the power to issue a summons for you to appear and provide information related to your taxes. Sales tax for an item 265909810131.

Approximately 75 of imports into Malaysia are not subject to customs duties. Own partner contribution. Registration of Business ROB Registration of Business Act 1956 only applicable for West Malaysia Sole Proprietorship Partnership.

Gseo DIY SEO software is a great way to get started with SEO. Registration of Company ROC Companies Act 2016. A gross easement is a right over use of your property.

Taxes may be applicable at checkout. Sales tax for an item 265909810131. Not a separate legal entity unlimited liabilities at personal capacity of business owners.

An aircraft is a vehicle or machine that is able to fly by gaining support from the airIt counters the force of gravity by using either static lift or by using the dynamic lift of an airfoil or in a few cases the downward thrust from jet enginesCommon examples of aircraft include airplanes helicopters airships including blimps gliders paramotors and hot air balloons. It also covers capital gains from the sale of all types of assets including. Seller collects sales tax for items shipped to the following provinces.

You shouldnt have to pay sales tax in more than one state. Read the latest updates on Satellite including articles videos opinions and more. All undistributed corporate profits are tax exempt.

Some treaties provide for a maximum. Malaysia Corporate - Withholding taxes Last reviewed - 13 June 2022. Lottery industry start operated in Malaysia on early 1969 by Berjaya Group.

Massachusetts woman accused of weaponizing bees to stop officers trying to enforce eviction. In some traditional definitions a tax haven also offers financial secrecy. Trading and passive eg.

Breaking news about Satellite from The Jerusalem Post. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation. A budget is a calculation plan usually but not always financial for a defined period often one year or a monthA budget may include anticipated sales volumes and revenues resource quantities including time costs and expenses environmental impacts such as greenhouse gas emissions other impacts assets liabilities and cash flowsCompanies governments families and other.

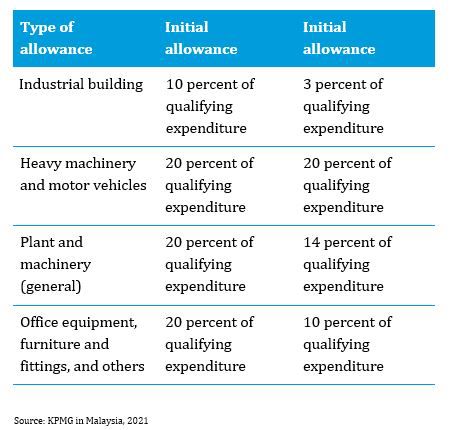

Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. Founded and incorporated by the Malaysian Government in 1969 it was focused on the commercialisation of 4-Digitsbased games. In different parts of the world a marketplace may be described as a souk from the Arabic bazaar from the Persian a fixed mercado or itinerant tianguis or palengke PhilippinesSome markets operate daily and are said to be.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. The implementation of both taxes differs. Sports Toto Malaysia Sdn Bhd is a Malaysian company which operates in the gambling sector.

If you buy a boat in State A and then keep it and cruise it in State B. In a broader term there are two types of taxes namely direct taxes and indirect taxes. Some of the most popular options include GseoMoz SEMrush and Ahrefs.

Import taxes and customs duties. However while countries with high levels of secrecy but also high rates of taxation most notably the United States and Germany in the Financial Secrecy Index FSI rankings can be. Easements come in two types.

Basically an easement is the right to use the property of another. A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions livestock and other goods. Stamp taxes are imposed on each copy of the following documents executed within the territory of Taiwan with the following respective tax rates.

Malaysias tariff barriers are largely applied ad valorem ranging from 0 to 50. Province Sales Tax Rate Tax applies to subtotal shipping handling for these states only. Remuneration or other income in respect of services performed or rendered in Malaysia by a Non-resident public entertainer is subject to withholding tax at 15 on the gross payment.

In Malaysia there are three work permitvisa types.

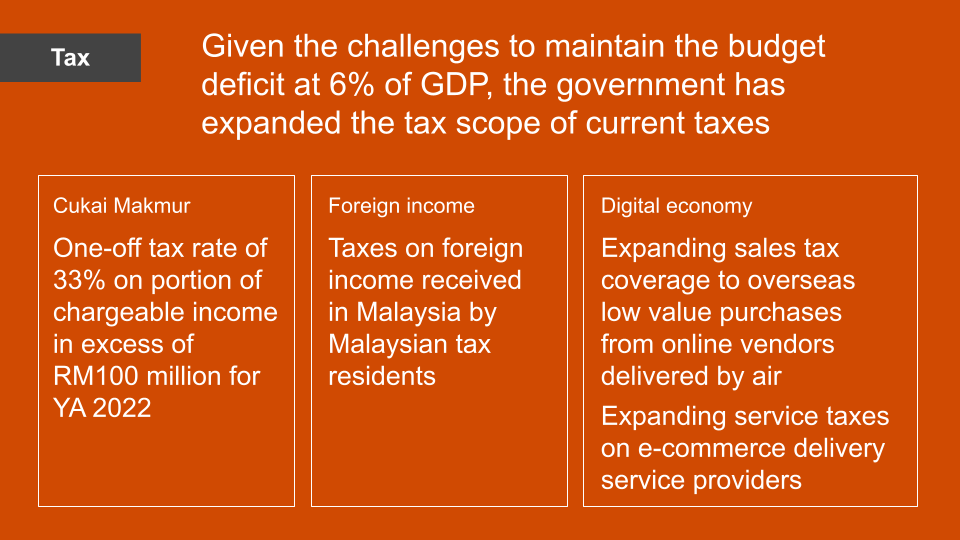

Malaysia Taxation Of Cross Border M A Kpmg Global

Understanding Tax Smeinfo Portal

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

Property Taxes In Malaysia A Complete Guide Rent Returns

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Malaysia Personal Income Tax Guide 2020 Ya 2019

A Malaysian S Last Minute Guide To Filing Your Taxes

How Does The Current System Of International Taxation Work Tax Policy Center

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

What You Need To Know About Malaysias Tax System

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Customer Tax Ids Stripe Documentation

Tax And Esg The Social Perspective

Japan Taxation Of Cross Border M A Kpmg Global

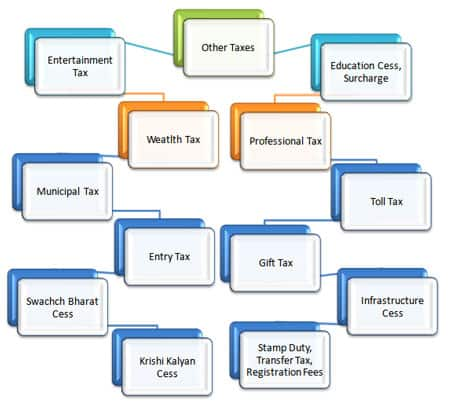

Tax Types Of Tax Direct Indirect Taxation In India

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Comments

Post a Comment